Sylmar Bankruptcy Attorney

Too much debt can lead to extreme anxiety, depression and family discord. Harassing phone calls from creditors, lawsuits and collection actions are like a plague in search of a cure. If you live in Sylmar or are a Sylmar businessperson with crushing debt, call a Sylmar bankruptcy attorney at (888) 754-9877 to see if bankruptcy might be the antidote to your financial woes.

The most common types of bankruptcy are Chapter 7, 11 and 13, all of which are handled by Sylmar bankruptcy attorneys. Chapter 7 allows eligible consumers and some businesses to discharge unsecured debt like credit cards, medical bill and department store bills and personal loans. Chapter 13 is a repayment plan whereby debtors can keep all their assets while paying back creditors over time. See a Chapter 13 Bankruptcy Attorney about eligibility.

Chapter 11 is generally for large Sylmar businesses like corporations, LLCs and partnerships that file to stay in business while restructuring their operations to repay creditors and work their way to solvency.

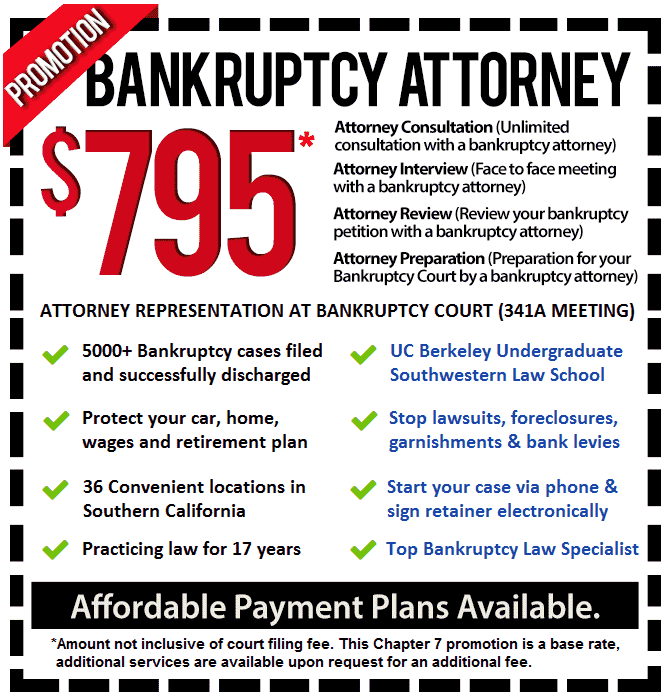

Any of these types of bankruptcy requires an evaluation by a Sylmar bankruptcy attorney to see if it can help your financial situation. Call a Sylmar bankruptcy attorney today for a consultation.

Chapter 7 Bankruptcy

Individuals, couples and any business can file Chapter 7. It eliminates unsecured debt for consumers who must qualify based on their income or amount of disposable income if it meets certain criteria. A Chapter 7 Bankruptcy Lawyer can see if you have assets subject to seizure by the trustee and if a Chapter 13 is more appropriate.

A Chapter 7 Bankruptcy Lawyer submits a petition listing your assets, liabilities, household expenses, existing leases and contracts and certain financial transactions. You and your Chapter 7 Bankruptcy Lawyer then meet the bankruptcy trustee to see if non-exempt assets are to be surrendered.

You do have certain obligations before and after filing about which your Chapter 13 Bankruptcy Attorney will advise. Most cases are discharged about 4 to 6 months after filing with your unsecured debts wiped out. Most secured debts can be reaffirmed, redeemed or collateral returned.

Corporations have to relinquish its assets and cease all operations. A Sylmar bankruptcy lawyer should discuss the liquidation process with corporate officers.

Chapter 13 Bankruptcy

If ineligible under Chapter 7 and your debts do not exceed certain limits, you can seek protection from creditors under Chapter 13 so long as you have a reliable income source. A Chapter 13 Bankruptcy Attorney evaluates your debts and disposable income and submits a repayment plan over 3 or 5 years. Creditors are paid in order of priority, such as a mortgage, car loan, taxes, child support and alimony. Filing does prevent home foreclosure and gives you time to pay arrearages.

Your Chapter 13 Bankruptcy Attorney can reduce the value of some secured debt to its market value to be included in the plan. If an unexpected event impairs your ability to pay, your Chapter 13 Bankruptcy Attorney could revise it.

Chapter 11 Bankruptcy

Corporations, LLCs and partnerships can revive their businesses in Chapter 11. A Chapter 11 Bankruptcy Lawyer files a disclosure statement and reorganization plan with strategies on regaining solvency and how creditors, placed into classes, are to be repaid. The reorganization plan must be confirmed by creditors though it can be forced on them.

There is no time limit on a Chapter 11. Debtor businesses continue operations with major decisions on restructuring requiring court approval. Your Chapter 11 Bankruptcy Lawyer will keep the court advised on progress, file the necessary reports and deal with creditor issues.

Small businesses that file are under greater court supervision though they can be fast tracked. Individuals with large debt and ineligible to file under Chapter 7 or 13 can file Chapter 11 though they should be assessed by a Sylmar bankruptcy lawyer regarding its feasibility.

Sylmar bankruptcy lawyers have the experience and knowledge Sylmar residents and businesses need. Call a Sylmar bankruptcy lawyer at (888) 754-9877 to discuss your options.