Pacoima Bankruptcy Attorney

For many people, debt anxiety is a nightmare fueled by daily phone calls from creditors, letters suggesting lawsuits or foreclosure or seizure activities. Fortunately, Pacoima residents and business owners can call a Pacoima bankruptcy attorney at (888) 754-9877 for advice on how to relieve crushing debt.

Bankruptcy is not a cure-all for financial problems but it can relieve debtors of substantial debt that is disrupting their lives and businesses. A Pacoima bankruptcy attorney can give you practical advice on how bankruptcy might be the solution to your debt problems.

For instance, a straight bankruptcy or Chapter 7 can wipe out unsecured debt like credit cards or medical bills. If you stand to lose valuable assets in a Chapter 7, a Pacoima bankruptcy attorney might recommend Chapter 13, a repayment plan that Pacoima sole proprietors can use as well. Businesses winding down their operations can file Chapter 7 that liquidates their assets to pay off creditors or choose to reorganize under Chapter 11.

Call a Pacoima bankruptcy attorney today to see if bankruptcy might be an option to get you on the path to a fresh start.

Chapter 7 Bankruptcy

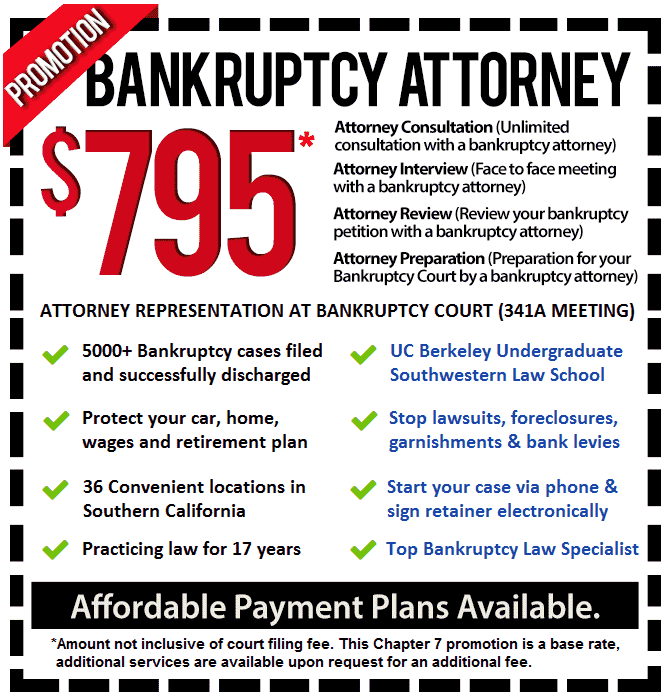

A straight bankruptcy allows Pacoima consumers to wipe out credit card, medical bills, department store bills, personal loans and payday loans. A Chapter 7 Bankruptcy Lawyer will determine your eligibility to file based on income and liabilities. If eligible, your Chapter 7 Bankruptcy Lawyer will then see if your assets are exempt from surrender or if other options are available.

Once you file, the Chapter 7 Bankruptcy Lawyer will file a petition of your debts, assets, expenses and other financial affairs for review by a trustee attended by you and your Chapter 7 Bankruptcy Lawyer. Also, your Chapter 7 Bankruptcy Lawyer will ensure that any potential issues are resolved before the meeting.

In most cases, there are few if any issues and your unsecured debts will be discharged. If a business, its assets will be liquidated and sold to satisfy creditors to some degree.

Chapter 13 Bankruptcy

If a Pacoima consumer is ineligible for Chapter 7, a Chapter 13 Bankruptcy Attorney may suggest a repayment plan under Chapter 13. Under the plan submitted by a Chapter 13 Bankruptcy Attorney, you will repay secured creditors in full and other priority creditors over 3 or 5 years. Unsecured debts are paid last if at all.

The plan can include arrearages in your mortgage, car loan, student loan, alimony, child support or taxes. Your Chapter 13 Bankruptcy Attorney can also reduce the value of some secured debt to its market value.

Sole proprietors can include business debt that was personally guaranteed. See a Chapter 13 Bankruptcy Attorney for additional information.

Chapter 11 Bankruptcy

Troubled Pacoima businesses can elect to file Chapter 11, or be forced into it by creditors. This is a reorganization proceeding where creditors are repaid over time, though some are not paid in full or are “impaired.” A Chapter 11 Bankruptcy Lawyer files a reorganization plan for confirmation by the impaired creditors and equity holders.

If it is confirmed, your business continues operating but its restructuring plan must be court-approved for any major business decisions such as sale of assets, hiring of specialists or breaking and re-negotiating contracts, leases and licenses. Your Chapter 11 Bankruptcy Lawyer files progress reports with the court and handles any creditor complaints.

If an individual, your Pacoima bankruptcy lawyer may advise that you can file Chapter 11 if certain circumstances are present.

Call a Pacoima bankruptcy lawyer at (888) 754-9877for how bankruptcy may be the legal option to relieve you of debt anxiety.